Experience Modification Rating (EMR) Explained

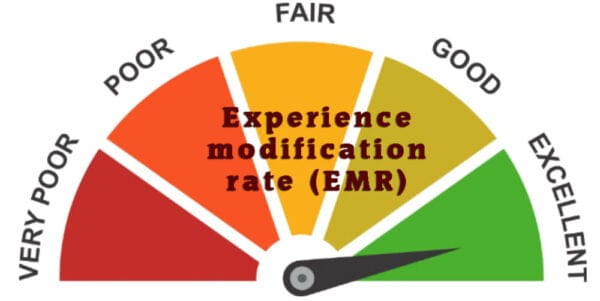

Experience Modification Rating (EMR), also known as Experience Modifier or Experience Modification Factor, is a numerical representation of a company’s workers’ compensation claims history and safety record as compared to other businesses in the same industry. It is used by insurance companies to adjust workers’ compensation premiums either upward or downward.

An EMR of 1.0 is considered the industry average, while a rating lower than 1.0 signifies a better-than-average safety record, and a rating higher than 1.0 indicates a worse-than-average record. This rating system incentivizes companies to maintain safe work environments and implement effective safety programs to reduce the number and severity of workplace injuries, ultimately affecting their insurance costs.

Table of Contents

Understanding the Impact of Experience Modification Rating on Your Business Insurance Costs

![]()

Experience Modification Rating (EMR) is a crucial metric that significantly influences the cost of a business’s workers’ compensation insurance premiums. It serves as a reflection of a company’s safety record and claims history in comparison to other businesses within the same industry. Understanding the impact of EMR on insurance costs is essential for business owners, as it not only affects their bottom line but also provides insights into their risk management practices.

The EMR, also known as Experience Modifier or Experience Mod, is a numerical representation of a company’s claims history and safety performance relative to its industry peers. It is calculated based on the number of claims filed and the corresponding costs, taking into account both the frequency and severity of workplace injuries and illnesses. An average EMR score is typically set at 1.0, which indicates that a business’s claims history is on par with industry standards. A score below 1.0 suggests a better-than-average safety record, while a score above 1.0 indicates a worse-than-average experience.

Insurance companies use the EMR to adjust workers’ compensation premiums accordingly. A lower EMR can lead to substantial savings on insurance costs, as it signals to insurers that the business is less risky to cover. Conversely, a higher EMR can result in increased premiums, reflecting the greater risk associated with insuring the business. Therefore, businesses with a strong focus on workplace safety and effective claims management are often rewarded with lower insurance costs.

The calculation of an EMR is complex and involves a review of a business’s claims history over a three-year period, excluding the most recent year. This lag period allows for the most recent claims to mature and provides a more accurate picture of the company’s risk profile. The National Council on Compensation Insurance (NCCI) or similar state-specific rating bureaus typically perform these calculations, and the resulting EMR is then used by insurance carriers to modify the standard premium.

It is important for businesses to recognize that their EMR is not a static number. It can fluctuate from year to year based on changes in their claims history. As such, proactive measures to improve workplace safety and reduce the number and severity of claims can lead to a lower EMR over time. This includes implementing comprehensive safety programs, providing employee safety training, and promptly addressing hazardous conditions.

Moreover, inaccuracies in the EMR calculation can occur, and these errors can unjustly inflate insurance costs. Businesses should, therefore, regularly review their EMR statements for accuracy and dispute any discrepancies. This vigilance ensures that they are not paying more than necessary for their workers’ compensation insurance.

In conclusion, the Experience Modification Rating is a vital component in determining a business’s workers’ compensation insurance premiums. A favorable EMR reflects a strong safety culture and effective risk management, leading to lower insurance costs. Conversely, a higher EMR can be a costly indicator of safety issues that need to be addressed. By understanding the impact of EMR and actively working to improve it, businesses can not only enhance their workplace safety but also achieve significant financial savings. This underscores the importance of EMR as a tool for businesses to manage their insurance expenses while fostering a safer work environment for their employees.

The experience modification rate calculation

The experience modification rate, often referred to as the experience mod or EMR, is a metric used primarily in the United States for workers’ compensation insurance. It’s a calculation that adjusts the cost of an employer’s workers’ compensation premiums based on the company’s claims history relative to other businesses in the same industry with a similar amount of payroll. The purpose of the experience modification rate is to incentivize workplace safety and loss prevention, as it rewards employers with lower insurance costs if they have fewer and less severe accidents compared to their industry peers.

Here is a more detailed explanation of how the experience modification rate calculation works:

1. Collection of Data: The process starts with the collection of the employer’s payroll and loss data (claims) over a certain period, typically three years of claims history excluding the most recent policy year.

2. Classification: Businesses are classified according to their industry. Each industry has a corresponding class code that reflects the inherent risks associated with that type of work.

3. Expected Losses: For each class code, expected loss rates are calculated, which represent the average historical loss for businesses in that class code per $100 of payroll. This serves as a benchmark for comparing an individual employer’s losses.

4. Actual Losses: The actual losses are the claims (both medical payments and indemnity) that the employer incurred during the experience period. These losses are divided into primary and excess losses, with primary losses carrying more weight in the calculation since they are considered more predictive of future risk.

5. Credibility: Different weights (credibility factors) are given to the actual losses based on the size of the employer. Larger employers with more payroll are considered more statistically reliable, so their actual experience influences their modification rate more heavily than it would for a smaller employer.

6. Experience Mod Calculation: The actual losses are compared to the expected losses for an employer of similar size in the same industry. If the actual losses are lower than expected, the experience mod will be less than 1.0, which will lower premiums. If the actual losses are higher, the mod will be more than 1.0, increasing premiums.

The formula for the experience mod is generally as follows:

FACTORS

A – Payroll (12 months of real wages only)

B – Job Classification Rate (Found at NCCI)

C – Discounts, Penalties & Assessments (Decided at the final stage for your premium)

D – Actual Loss (Total Actual Incurred Losses)

E – Actual Primary Loss (Actual Loss below the amount of $17,000)

F – Actual Excess Loss (D – E)

G – Expected Primary Loss (K x J)

H – Expected Excess Loss (K – G)

I – Expected Loss Rate (Found at NCCI)

J – Discounted Ratio (Found at NCCI)

K – Expected Loss (A x I) / 100)

L – Actual Rate (E+F(H))

M – Expected Rate (G+H(H))

FORMULA

ACTUAL RATE (L) = E + F x H

EXPECTED EXPECTED (M) = G + H x H

EXPERIENCE MODIFICATION RATE = L / M

The discount factor reduces the impact of large losses on the experience mod, since such losses are less predictive of future claims.

7. Application: Once calculated, the experience mod is applied to the employer’s workers’ compensation premium. An experience mod of 1.0 indicates that the employer’s losses are exactly what’s expected for their industry and size, and thus their premiums remain unchanged. An experience mod greater than 1.0 means the employer’s losses were worse than expected, resulting in higher premiums, while an experience mod less than 1.0 means the losses were better than expected, resulting in lower premiums.

It’s important to note that regulations and specific calculation methods can vary by state, and the National Council on Compensation Insurance (NCCI) manages the experience rating for many states, but not all. Some states have their own rating bureaus, and a few large employers may be self-insured and not subject to experience rating.

Frequently Asked Questions

![]()

What is an Experience Modification Rating (EMR)?

An Experience Modification Rating, also known as an Experience Modifier or EMR, is a metric used by insurance companies to gauge both past cost of injuries and future chances of risk. The lower the EMR of your business, the lower your worker compensation insurance premiums will be.

How is an EMR calculated?

An EMR is calculated based on the number and severity of workers’ compensation claims filed against a company compared to the average in that industry. It typically involves three years of claims history, excluding the most recent policy year. The calculation takes into account the expected number of claims for similar companies in the same industry.

What is the average EMR?

The average EMR is set at 1.0. An EMR greater than 1.0 suggests that a company has a claims history that is worse than average, leading to higher premiums, while an EMR less than 1.0 indicates a better than average claims history, resulting in lower premiums.

Can an EMR change over time?

Yes, an EMR can change over time as it is recalculated annually to reflect the most recent three years of claims data. As a result, if a company reduces its number and severity of claims, it can lower its EMR over time.

Why is EMR important to businesses?

A lower EMR can give a business a competitive edge by reducing insurance costs, which can have a significant impact on the company’s bottom line. Additionally, some clients may look at a company’s EMR as a factor when deciding to award contracts, viewing a lower EMR as a sign of a safer and more responsible workplace.

How can a business reduce its EMR?

A business can reduce its EMR by implementing safety programs, reducing workplace hazards, and encouraging safe work practices. Prompt and efficient management of injuries and return-to-work programs can also help in lowering the EMR.

Does every business have an EMR?

Not every business has an EMR. Generally, it is assigned to a company that meets specific criteria set by the insurance rating bureau in their state, such as a minimum amount of premium paid for workers’ compensation insurance or a minimum number of years in business.

What should a business do if it believes its EMR is incorrect?

The business should immediately review its EMR calculation sheet for any inaccuracies in payroll, classification codes, or claims data. If errors are found, the business should contact its insurance agent or the rating bureau responsible for calculating the EMR to dispute the mistakes and have them corrected.

Can new businesses have an EMR?

New businesses typically start with the industry average EMR of 1.0. As they build their claims history, their EMR can be adjusted accordingly.

Is the EMR the only factor affecting workers’ compensation premiums?

No, while the EMR is a significant factor, other elements such as the type of industry, the company’s payroll, and the state in which the company operates can also affect workers’ compensation premiums.

Conclusion

![]()

The Experience Modification Rating (EMR) is a significant metric used in the insurance industry, particularly in workers’ compensation insurance, to gauge a company’s safety record and past cost of injuries. It compares a company’s historical cost of injuries and risk of future injuries to the average for other companies in the same industry. A lower EMR indicates a better-than-average safety record, which can result in lower insurance premiums, while a higher EMR suggests a worse-than-average record, leading to higher premiums. Therefore, maintaining a low EMR is crucial for businesses as it reflects a commitment to workplace safety and can have a direct impact on their insurance costs.

Originally posted 2022-10-05 14:13:49.