Tips for Getting Cheap Auto Insurance

Finding affordable auto insurance can be a challenge, but with the right strategies, you can reduce your premiums and save money. By understanding the factors that influence insurance rates and taking advantage of discounts and comparison shopping, you can secure a policy that offers good coverage without breaking the bank. Here are some tips to help you get cheap auto insurance while still ensuring you’re adequately protected on the road.

Table of Contents

10 Essential Tips for Finding Cheap Auto Insurance Deals

![]()

Securing affordable auto insurance is a goal for many drivers, as it can significantly reduce monthly expenses while still providing essential coverage. To navigate the often complex world of insurance and find the best deals, it’s important to be equipped with the right strategies. Here are ten essential tips to help you find cheap auto insurance without compromising on quality.

Firstly, it’s crucial to shop around and compare quotes from multiple insurance providers. Prices for the same coverage can vary widely between companies, so by obtaining several quotes, you can ensure you’re getting the most competitive rate. Online comparison tools can streamline this process, allowing you to view a range of offers quickly.

Secondly, consider bundling your auto insurance with other policies, such as homeowners or renters insurance. Many insurers offer discounts for multiple policies, which can lead to significant savings. This not only simplifies your insurance management but also strengthens your relationship with the insurer, potentially leading to further discounts.

Thirdly, maintain a clean driving record. Insurers often reward safe drivers with lower premiums. Avoiding accidents and traffic violations can demonstrate to your insurance company that you’re a low-risk client, which can translate into cheaper insurance rates over time.

Fourthly, increase your deductible if you can afford to do so. A higher deductible reduces the insurer’s risk, which can result in lower premiums for you. However, ensure that you have enough savings to cover the deductible in case of an accident.

Fifthly, take advantage of discounts. Many insurers offer a variety of discounts for things like being a good student, having a car with safety features, or even for paying your premium in full rather than in installments. Always ask your insurer about available discounts and how you can qualify for them.

Sixthly, consider the type of car you drive. Vehicles that are cheaper to repair or are not frequently targeted by thieves typically have lower insurance rates. Before purchasing a new or used car, research how its make and model will affect your insurance costs.

Seventhly, use telematics programs if offered by your insurer. These programs track your driving habits and can provide discounts for safe driving. This not only encourages better driving behavior but can also lead to lower insurance rates.

Eighthly, maintain good credit. In many states, insurers use credit scores as one factor in determining premiums. A higher credit score can indicate to insurers that you’re financially responsible, which may result in lower rates.

Ninthly, consider the coverage you truly need. While it’s important not to be underinsured, carrying more coverage than necessary can lead to higher costs. Evaluate your coverage annually to ensure it still meets your needs, and adjust accordingly.

Lastly, stay informed about changes in the insurance industry and regulations in your state. Legislation can affect insurance rates, and being aware of these changes can help you anticipate shifts in pricing or available discounts.

To get cheap auto insurance, consider the following tips:

- Shop around and compare quotes from multiple insurers.

- Bundle your auto insurance with other policies, such as homeowners or renters insurance.

- Increase your deductibles to lower your premiums.

- Maintain a clean driving record and good credit score.

- Take advantage of discounts for things like safe driving, anti-theft devices, and low annual mileage.

- Choose a car with safety features and a low insurance cost.

- Consider usage-based insurance if you don’t drive much.

- Review your coverage regularly to ensure it still meets your needs without unnecessary extras.

By following these tips, you can find cheap auto insurance deals that provide the coverage you need at a price you can afford. Remember that the cheapest option is not always the best, so balance cost with the quality of coverage and service. With a little research and the right approach, you can secure an auto insurance policy that offers both value and peace of mind.

Frequently Asked Questions

![]()

Q1: How can I get the cheapest auto insurance?

A1: To get the cheapest auto insurance, compare quotes from multiple providers, choose a policy with only the coverage you need, increase your deductibles, maintain a clean driving record, take advantage of discounts, bundle policies if possible, and regularly review your policy to ensure it still meets your needs at the best price.

Q2: Does my driving record affect my insurance rates?

A2: Yes, your driving record significantly affects your insurance rates. A clean record without accidents or traffic violations will typically result in lower premiums. Conversely, having a history of accidents or infractions can increase your rates.

Q3: Can my credit score impact my auto insurance rates?

A3: In many states, insurers use credit scores as one factor in determining insurance premiums. A higher credit score can lead to lower insurance rates, while a lower score may result in higher premiums.

Q4: What discounts should I look for when purchasing auto insurance?

A4: Look for discounts such as multi-car, good driver, good student, low mileage, safety features, defensive driving course completion, and loyalty discounts. Always ask your insurance provider about any discounts for which you may be eligible.

Q5: Is it cheaper to buy auto insurance online?

A5: Buying auto insurance online can be cheaper as it saves the insurance company overhead costs, which may be passed on to the customer. Plus, it’s easier to compare rates and policies online. However, this is not always the case, so it’s important to compare both online and offline options.

Q6: How does the deductible affect my auto insurance premiums?

A6: Generally, the higher your deductible (the amount you pay out of pocket before insurance kicks in), the lower your premium will be. However, make sure you choose a deductible amount that you can afford to pay in case of a claim.

Q7: What types of coverage can I drop to save money on my auto insurance?

A7: It depends on your individual situation, but you might consider dropping or reducing coverage like collision and comprehensive if you drive an older car that’s not worth much more than the deductible. Always weigh the risk of carrying less coverage against the potential savings.

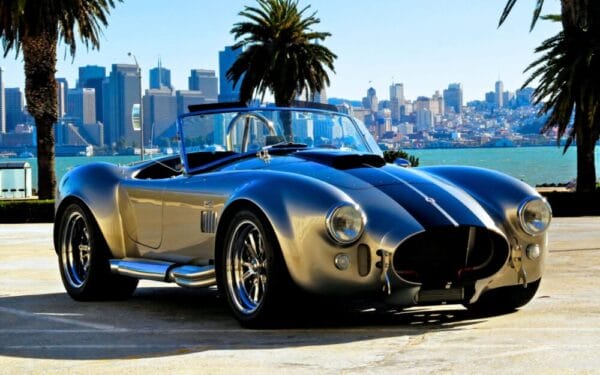

Q8: Can the type of car I drive affect my insurance rates?

A8: Yes, the car’s make, model, and year can affect your rates. Cars that are expensive to repair, have a high theft rate, or are powerful and sporty can cost more to insure. Choose a car with a good safety record and low repair costs to help reduce premiums.

Q9: Should I only carry the minimum required insurance to save money?

A9: Carrying only the minimum required insurance can save money in the short term, but it can be risky. If you’re in an accident and the damages exceed your coverage limits, you’ll be responsible for paying the difference, which could be financially devastating. Consider your assets and what you can afford to lose when deciding on coverage limits.

Q10: How often should I shop around for auto insurance?

A10: It’s a good idea to shop around for auto insurance at least once a year or whenever there is a significant change in your driving situation, such as buying a new car, moving to a new area, or adding a new driver to your policy. Regularly comparing rates can help you ensure you’re still getting the best deal.

Conclusion

![]()

To secure cheap auto insurance, it’s essential to shop around and compare quotes from multiple insurers, maintain a good driving record, choose a car that is cheaper to insure, increase your deductibles, bundle insurance policies, take advantage of discounts, improve your credit score, and consider usage-based insurance. By implementing these strategies, you can potentially lower your auto insurance premiums and save money over time.

Originally posted 2022-09-12 15:00:17.